Kwik Cash offers a convenient and hassle-free process of getting a personal loan. Monthly loan payments are usually credited through a savings and checking account. The provider has been funding thousands since 2007.

- Website: https://www.kwikcashonline.com/

- Mobile App: Not Available

- Telephone Number: 1-800-478-6230

- Founded: 1993 (32 years ago)

- Company's Rating:

Kwikcash is a leading loan provider that operates in nine states in the U.S. Its online service offers an easy and convenient way for customers to apply for loans and enjoy other member benefits. This article provides easy steps to logging into your account, resetting your password, enrolling and managing your account.

How to login

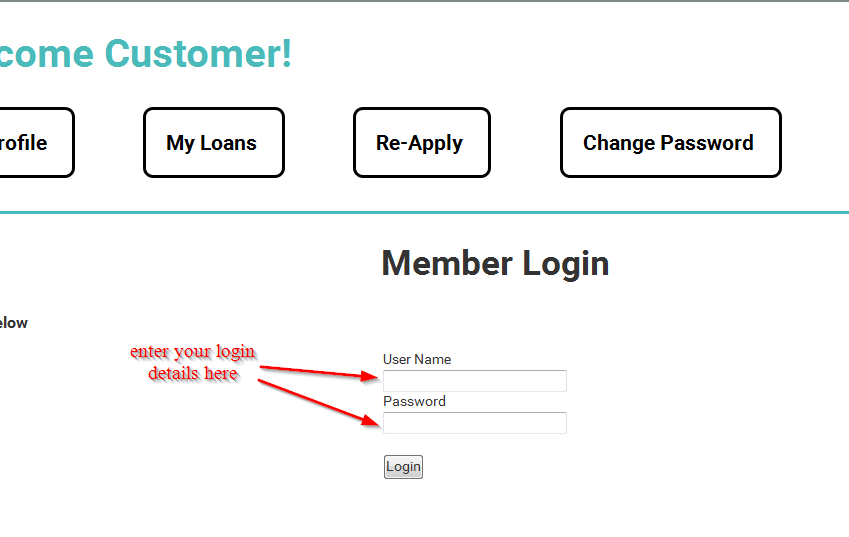

It is very easy to login into your Kwikcash account. But you must have an account with the provider to be able to login. Here are the steps you should follow:

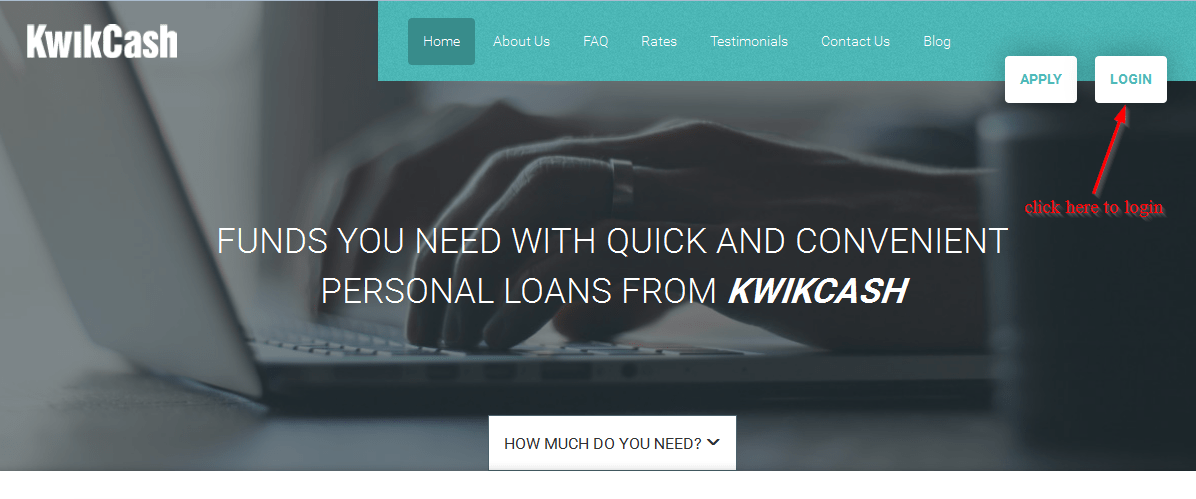

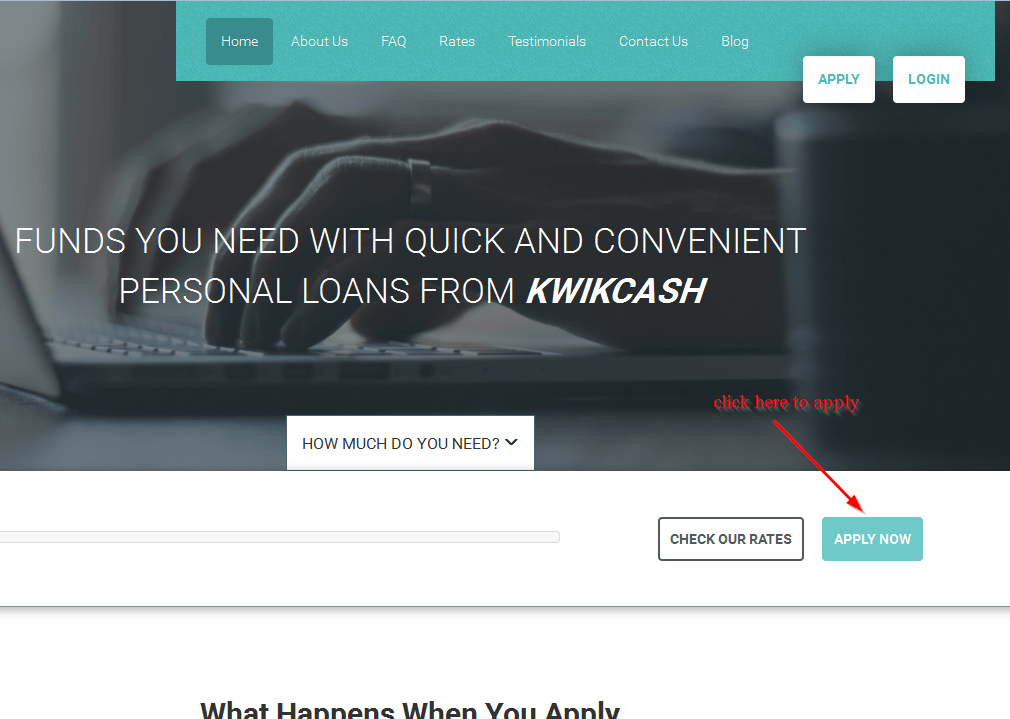

Step 1-Open your web browser on your computer and go to http://kwikcashonline.com/

Step 2-Click ‘Login’

Step 3-Enter your username and password, and click ‘login’

Forgot your password?

If you can’t access your account because you have forgotten, you can reset it by following these simple steps:

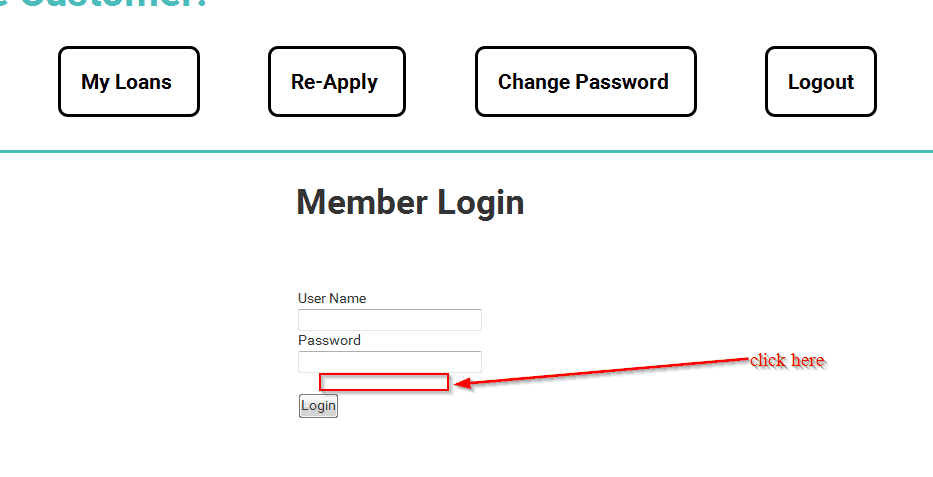

Step 1-Go to the Homepage and click ‘login’

Step 2-Click ‘Forgot your username or password’ as shown in the image below

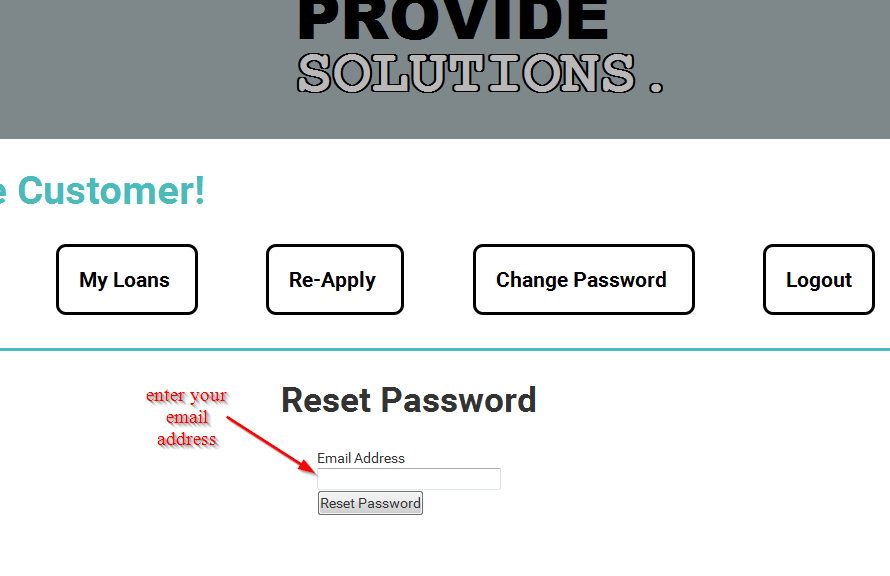

Step 3-Enter your email address and click ‘reset password’

You will receive an email with a password reset link. Click on the link to retrieve your password.

How to apply for a loan

Applying for a personal loan from Kwikcash is very simple. All you need is a computer and reliable internet connection. Here are the steps to follow to successfully apply for a loan:

Step 1-Click ‘apply’ as shown on the image below

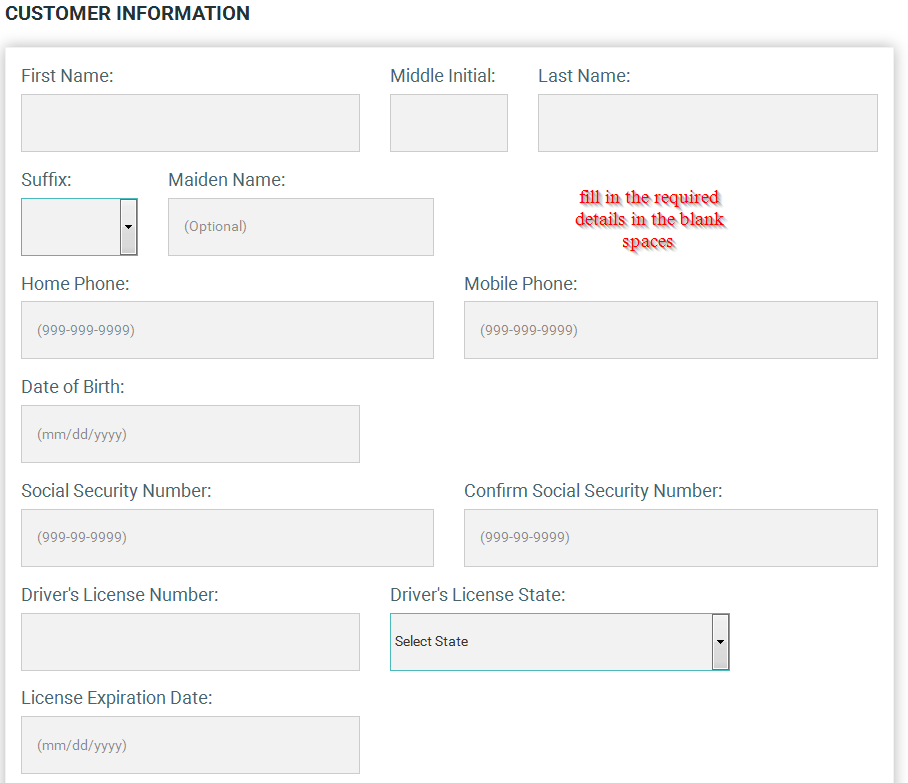

Step 2-Fill in your names, phone number, date of birth, social security number, driver’s license number, email address, preferred communication method and home address, and click ‘next’

You will be required to complete two more steps to apply for the loan.

Manage your Kwikcash account

You may be wondering why you need to use Kwikcash online services. Well, when you apply to a loan through the website:

Your application will be pre-approve automatically or denied. It may also be sent to the underwriting department.

You can upload supporting documents if your loan is pre-approved. This will serve as proof of income and allow the loan provider to wire the money.

The documents will then be sent to the underwriting department and if approved, the fund will be wired the same day.

(5 votes, average: 3.80 out of 5)

(5 votes, average: 3.80 out of 5)