- 1st Bank Login Tutorial & Info

- Bank's Rating:

1st Bank was founded in 1963. FirstBank currently has an asset base of over $15 billion and more than 120 locations in Colorado, Arizona, and California.

ROUTING NUMBERS

For a customer to receive fund transfers from other financial institutions in 1st Bank account, he or she must provide the bank routing number.

The 1st Bank routing number is 107005047

WHERE TO FIND ON A CHECK

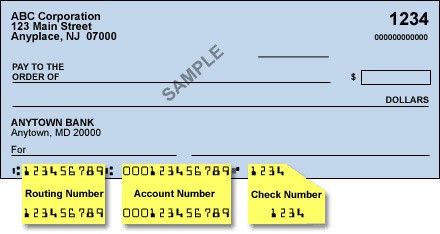

With a 1st Bank check, you can easily get the bank routing number.

The sample check image below shows where the routing number can be found at the bottom of the check.

HOW TO WIRE MONEY

For quick and convenient fund transfers, wire transfer is the best way to do it in 1st Bank.

1st Bank customers are allowed to make both Domestic Wire Transfers and International wire transfers.

SWIFT Code is a must if you want to receive any international wire transfer.

For the wire transfer to start, the customer is required to provide the sending financial institution with his or her bank account details.

If you are a 1st Bank account holder, you can perform wire transfers online or by visiting the local branch.

Domestic Wire

Domestic wire transfers normally take 24 hours to be completed.

For a customer in 1st Bank to receive a wire, he or she must provide the following information to the party that is originating the wire.

- Bank Name – 1st Bank

- Routing Number – 107005047

- Address of Bank – Lakewood, Colorado

- Beneficiary’s Name – Your name

- Beneficiary’s Account Number – Your Berkshire Bank account number

International Wire

To receive a wire at 1st Bank, the following information should be provided to the party that is originating the wire.

- Swift Code – FBCRUS51XXX

- Bank Name – 1st Bank

- Routing Number – 107005047

- Address of Bank – Lakewood, Colorado

- Beneficiary’s Name – Your name

- Beneficiary’s Account Number – Your full account number

Wire Transfer Fees for 1st Bank

International and Domestic Wire Transfer fees differ in 1st Bank depending on whether they are incoming or outgoing.

Here is the breakdown:

International Wire Transfers – $10 for each incoming transaction and $45 for each outgoing transaction.

Domestic Wire Transfers – $10 for each incoming transaction and $30 for each outgoing transaction.