- Bank of Hawaii Login Tutorial & Info

- Bank's Rating:

Bank of Hawaii is the main subsidiary of Bank of Hawaii Corporation, which is a regional bank holding company. In 1897, Bank of Hawaii became the first incorporated and chartered bank to do business in Republic of Hawaii.

ROUTING NUMBERS

Federal Reserve Banks use routing numbers to process funds transfers in the US.

Bank of Hawaii routing number is 121301028.

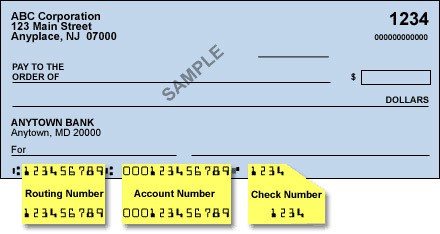

WHERE TO FIND ON A CHECK

The check you receive from your US bank has your branch routing number.

To know where to locate it on your Bank of Hawaii check, have a look at the sample check shown below.

HOW TO WIRE MONEY

If you need to send money fast, Bank of Hawaii can help you through its Wire Services.

Bank of Hawaii through its Wire Services allows customers to wire money in the U.S. with Fedwire, and abroad through its partner institutions across the world.

Bank of Hawaii ensures your funds are placed wherever you need them, fast.

Bank of Hawaii is a member bank of S.W.I.F.T network which allows for efficient worldwide transfer of funds.

Domestic Wire

Bank of Hawaii customers can receive domestic wire transfers once they provide the sender with the following information.

- Bank Name – Bank of Hawaii

- Routing Number – 121301028

- Address of Bank – Honolulu, HI

- Beneficiary’s Name – Your name as it appears in your statement

- Beneficiary’s Account Number – Your full Bank of Hawaii account number

International Wire

To receive international wire transfers in your account, you will have to provide the international sender with the necessary information shown below.

- Swift Code – BOHIUS77

- Bank Name – Bank of Hawaii

- Routing Number – 121301028

- Address of Bank – Honolulu, HI

- Beneficiary’s Name – Your name as it appears in your statement

- Beneficiary’s Account Number – Your full Bank of Hawaii account number

Wire Transfer Fees for Bank of Hawaii

Bank of Hawaii charges you a fee for each international and domestic wire transfer you receive or make.

The fee usually varies the depending on the type of transaction.

Here is the breakdown.

International Wire Transfers – $13 for each incoming transaction and $45 to $75 for each outgoing transaction depending on account type.

Domestic Wire Transfers – $13 for each incoming transaction and $40 for each outgoing transaction $5000 or less as well as $75 for more than $5000 for each outgoing transaction.

Is there any limit for international wire transfer?