- Chase Bank Login Tutorial & Info

- Bank's Rating:

Chase Bank is a personal and commercial branch bank owned by JPMorgan Chase & Co. With over 5,300 branches all across the US, Chase Banks offers multiple financial services such as personal banking, mortgages, small business loans and auto financing.

ROUTING NUMBERS

Chase Bank routing number is necessary for receiving wire transfers into your account.

Chase Bank routing numbers are listed below.

Select the routing number that correctly corresponds with the region where you opened the account.

- 122100024 – Arizona

- 322271627 – California

- 102001017 – Colorado

- 021100361 – Connecticut

- 267084131 – Florida

- 061092387 – Georgia

- 123271978 – Idaho

- 071000013 – Illinois

- 074000010 – Indiana

- 083000137 – Kentucky

- 065400137 – Louisiana

- 072000326 – Michigan

- 322271627 – Nevada

- 021202337 – New Jersey

- 021000021 – New York – Downstate

- 022300173 – New York – Upstate

- 044000037 – Ohio

- 103000648 – Oklahoma

- 325070760 – Oregon

- 111000614 – Texas

- 124001545 – Utah

- 325070760 – Washington

- 051900366 – West Virginia

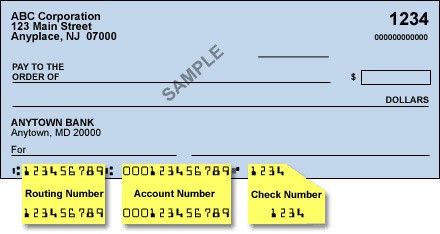

WHERE TO FIND ON A CHECK

The easiest way to find your routing number is to look at your checks.

The following check image will show you where to look to locate routing number in your check.

Note: Chase’s routing number is the first nine digits printed across the bottom of your check.

HOW TO WIRE MONEY

Wire transfers provide the fastest way to transfer funds into your Chase Bank account.

Chase Bank allows you receive both international and domestic wire transfers.

The transaction begins when the sender is provided with the following bank and account details.

SWIFT code is needed for International wire transfers.

With Chase Bank, you can make wire transfers online or by visiting the nearest branch.

Domestic Wire

Domestic wire transfers allow you receive funds quickly.

For you to receive domestic wire transfers, you must provide the following bank and account details to the financial institution to initiate the transaction.

- Bank Name – Chase Bank

- Routing Number – 021000021

- Address of Bank – Columbus, OH

- Creditor’s Name – Your name as it appears on your statement

- Creditor’s Account Number – Your Chase Bank account number

International Wire

Chase Bank allows you to receive and send international funds through its international wire transfer capability.

Through Chase, you can send payments in more than 35 different currencies across the world.

To receive wire transfers in your Chase Bank account, you must provide the following bank and account information to the transferring financial institution.

- Swift Code – CHASUS33

- Routing Number – 021000021

- Bank Name – Chase Bank

- City, State – Columbus, OH

- Customer’s Name – Your name as it appears on your statement

- Customer’s Account Number – Your Chase Bank account number

Wire Transfer Fees for Chase Bank

Wire transfers fees in Chase Bank vary depending on whether they are domestic or international and whether you are receiving or sending funds. Below is the breakdown of the fees.

International Wire Transfers – $15 for every incoming transaction and $45 for each outgoing transaction made at a local branch and $40 made online.

Domestic Wire Transfers – $15 for every incoming transaction and $25 for every outgoing transaction made online and $30 made at a local branch.

Slate b me back

Please list the phone number that should be used for incoming wire transfers. It’s a required field on the sending side. (Schwab)