- Union Bank Login Tutorial & Info

- Bank's Rating:

The modern Union Bank was formed in 1996 after the merger of The Bank of California and Union Bank to create Union Bank of California. The bank is a fully fledged bank with offices across the United States.

ROUTING NUMBERS

Union Bank customers can receive wire transfers once the sending bank uses Union Bank’s routing number.

Below are the institution’s routing numbers based on the location.

- 122000496 – California

- 122000496 – Georgia

- 122000496 – Illinois

- 026005050 – New York

- 122000496, 123000068 – Oregon

- 111026041 – Texas

- 122000496, 125000118 – Washington

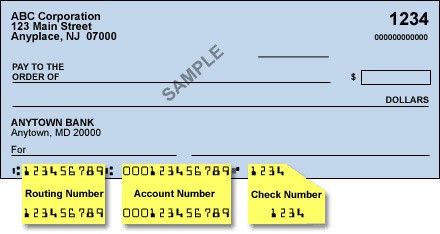

WHERE TO FIND ON A CHECK

Union Bank routing number can easily be located on the bank’s check.

The following image shows where you can locate the routing number on the check.

Note: The routing number is the first nine digits at the bottom of the page

HOW TO WIRE MONEY

Union Bank allows you wire funds from your account to any bank account in the United States.

Wire transfer is a great option if you need your funds to arrive the same day at a fee.

SWIFT Code is required before you can receive or send international wire transfers.

The process of transferring funds begins after the sending financial institution receives the required information from the recipient.

Union Bank allows its customers perform wire transfers online or by visiting the nearest branch.

Domestic Wire

Union Bank allows you receive domestic wire transfers.

To receive domestic wire transfers, you must provide the following details to initiate domestic wire transfer.

- Bank Name – Union Bank NA

- Routing Number – 122000496

- Address of Bank – San Francisco, CA

- Beneficiary’s Name – Your name as it appears on your statement

- Beneficiary’s Account Number – Your full Union Bank account number

International Wire

Union Bank allows its customers receive international wire transfers

To receive international wire transfers, provide the following details to the sending bank.

- Swift Code – BOFCUS33MPK

- Bank Name – Union Bank NA

- Routing Number – 122000496

- Address of Bank – San Francisco, CA

- Beneficiary’s Name – Your name as it appears on your statement

- Beneficiary’s Account Number – Your full Union Bank account number

Wire Transfer Fees for Union Bank

International and domestic wire transfer fees in Union Bank vary depending on if the transactions are incoming or outgoing.

Here is the breakdown:

International Wire Transfers – $14 for each incoming transaction and for each outgoing transaction $35 (for foreign currency) or $45 (for USD).

Domestic Wire Transfers – $14 for each incoming transaction and $25 for each outgoing transaction.

(7 votes, average: 3.43 out of 5)

(7 votes, average: 3.43 out of 5)

Happy New year!

I’m hoping for a DEPOSIT from Friends & , Family …how long does this take?!!

The waiting and anticipation of doubts when there should be none, is getting a doubtful fearful &…This just not like them.

SOS…need of payday loan and pray fully Installment prompt

😔✨