ROUTING NUMBERS

Federal Reserve Banks in the US when processing Fedwire funds transfers and other automated transfers require a routing number. Barclays account holders can receive domestic wire transfers after providing Barclays bank routing number.

Barclays Bank routing/ABA number is 031101321.

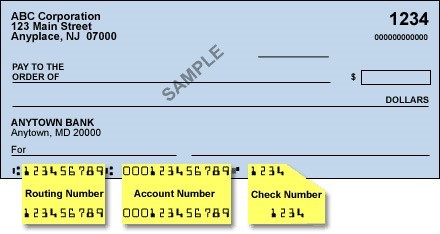

WHERE TO FIND ON A CHECK

Barclays Bank account holders can easily find routing number on the bottom of the check.

The following sample check image highlights where the routing number can be obtained on the bottom of your check.

HOW TO WIRE MONEY

Barclays Bank allows holders to receive and make wire transfers both international and domestic.

Account holders can make wire transfers via the online banking platform or by visiting the local Barclays branch. Wire transfers attract a processing fee and you need to confirm with customer service prior to initiating the transaction.

International wire transfers into your Barclays Bank account, requires you provide the sending financial institution with Barclays Bank’s swift code.

Domestic Wire Transfers

Barclays Bank account holders can receive domestic wire transfer after providing the sending financial institution with the following details to initiate the wire transfer:

- Bank Name – Barclays Bank

- Routing Number – 031101321

- Address of Bank – Lombard Street, London.

- Beneficiary’s Name – Your name

- Beneficiary’s Account Number – Your Barclays Bank account number

International Wire Transfers

To receive international wire transfer into your Barclays Bank account, the following information should be provided to the financial institution sending the wire transfer:

- Swift Code – BARCGB22

- Bank Name – Barclays Bank

- Routing Number – 031101321

- Address of Bank – Lombard Street, London.

- Beneficiary’s Name – Your name

- Beneficiary’s Account Number – Your Barclays Bank account number

Wire Transfer Fees for Barclays Bank

Barclays Bank’s International and Domestic Wire Transfers attract a processing fee regardless of whether the transfers are incoming or outgoing. The fee breakdown is shown below:

International Wire Transfers – £6 (If the payment is in a different currency, or

is received from a country outside of the EU/EEA) for each incoming transaction and £15 (priority online) or £40 (priority by telephone or at the branch) or £25 (standard telephone or at the branch) for each outgoing transaction.

Domestic Wire Transfers – £0 (for euro payments from EU/EEA countries for) or each incoming transaction and £6 (online) or £15 (by telephone or at the branch) for each outgoing transaction.

can i have a sample of a bank transfer from.barclay to an acxount here in the philippines.because a certain person sent a copy of a “supposedly”bank trans to our Banco De Oro account.

Just to clarify. I’m receiving a wire from the UK into my Barclays US account. Am I using the Lombard UK address when I send out the instructions with BARCGB22?

Thanks