Credit cards may have a bad name these days, but in the right hands…

…they can be a powerful tool in your financial arsenal.

Too many cases of people racking up debt have given credit cards a reputation as being an irresponsible and even dangerous way to spend money.

But it doesn’t have to be that way.

Credit cards are actually necessary in today’s society, where everything from renting an apartment to buying a card depends on having a good credit history.

The trick is to spend responsibly and become an educated credit card user.

Educate yourself and you can even learn to use your card to save you money!

Check out our list of tips and tricks to get the most out of your credit card:

General Good Practice for Using a Credit Card:

- Don’t just pay the minimum amount: Most people who get into trouble using a credit card do so by only paying the minimum amount each month. In fact, your bank is hoping that you will do this, because then they get to charge you interest, which can add up to a fortune extremely quickly. If you have a balance of $100 owing on your card, you will not get very far paying it back by making a minimum payment of $25, especially if you spend more money the next month. Pay as much of your balance as possible every month to avoid huge interest charges.

- Pay in full every month: If you can, pay the full balance every month in order to avoid paying interest completely. Most credit cards offer a grace period before they begin to charge you interest, so paying in full every time can save you money.

- Be aware of how long your grace period is: Different cards will grant you a different number of interest-free days, so make sure you know exactly how much time, if any, you have between a transaction and the end of its grace period. Most credit cards allow between 20-30 days before charging interest, though some will charge you interest from the time of the transaction.

- Never miss a payment: Missing a credit card payment even once can negatively affect your credit score as well as costing you money in fees and interest. Even if you can’t pay in full every time, pay at least the minimum amount every single month.

- Don’t max out your card: Maxing out your card is not only unwise as it leaves you no wiggle room in the event of an emergency or unexpected fee, it is also bad for your credit score.

- Live within your means: Don’t spend more money than you have. Credit cards have made it possible for people to live way beyond their means, but this irresponsible behavior will come back to haunt you in the form of debt and a poor credit score. Credit is still money, and you do need to put real money into your credit account, so only spend what you can quickly pay back.

Tips to Avoid Unnecessary Expenses:

- Don’t use your credit card overseas: Using your card overseas can incur extra fees and charges.

- Avoid cash advances: A cash advance is when you use an ATM to take cash from your credit card account to spend later. As your bank has no way to know how you will spend this cash, it sees this as a risky transaction and may charge you interest from the date of the transaction. Check your credit card agreement to see how your bank handles cash advances.

- Be aware of penalties and fees: You may incur a penalty for missing a payment, exceeding your credit limit and so on. Check your credit card agreement to see what fees you are liable to pay.

- Use autopay or direct debit: You can set up your bank accounts so that your credit balance is automatically paid every month, so that you never risk forgetting to make a payment. The only thing you need to make sure of is that your other debit account has enough money in it to fund your credit payments. Options may include using direct debit to pay the minimum amount, a fixed monthly sum or the full balance.

- Negotiate with your bank: If it looks like you won’t be able to make your minimum payment for the month, don’t just do nothing. Contact your bank and they may be willing to negotiate a deal to prevent you incurring a penalty.

- Avoid paying an annual fee: While many credit cards don’t charge an annual fee, some do. This is generally an unnecessary expense many customers avoid according to their choice of card. Some cards will lure customers in with tempting cashback or rewards offers, hoping to charge them an annual fee later on. Many such cards offer the first year free, only charging you from the second year onwards. Strategic credit card users may take advantage of these special deals for the first year, then choose to cancel the card just before incurring the first annual fee.

- Use single-cycle billing cards: Single-cycle billing (also known as one-cycle billing) is a system a bank uses to determine how much interest you owe. The bank counts your balance daily, then divides the total by the number of days in the month. This number is then multiplied by the interest rate to figure out how much interest you owe for the month. Some credit cards use double or two-cycle billing, however. This involves the same calculation process, but counted over this month and also the previous month, meaning that you are charged two times for interest on older balances. Check with your bank to see how you are being billed and choose a single-cycle card if possible.

Tips for If You Have an Existing Debt or Bad Credit Score:

- Use balance transfer cards: It may be difficult to get a new card if you have an existing credit debt, but balance transfer cards usually offer a period of time interest-free, which can really help you to get on top of your debt. If you have otherwise good credit, but have recently struggled to pay your credit card in full, you may be able to use the brief reprieve of such a new card to pay back your debt, as long as you choose the right one.

- Don’t use rewards: If you are carrying your balance from month to month, forget about rewards. The interest you are paying will outweigh any benefit of rewards or cashback, so plan your spending according to the money you already have.

- Get a secured card: If you are struggling to get approval for new cards, your best bet is probably a secured card. This is a type of credit card that requires you to put down a deposit with the provider, which becomes your line of credit. For example, if you put down a deposit of $300, you will then have a maximum of $300 of credit available to you in your account. Secured cards are a good option for people who are seen as a credit risk by the bank, as they can access your deposit as collateral, should you fail to pay off your card.

- Work your credit card into your budget: Rather than using a credit card to make impulse or luxury purchases that you can’t pay off, instead work credit into a your budget strategically as a means to improve your credit Score. Plan credit purchases in advance and make sure they fit into your budget, always making sure you will have the cash to pay them off in time.

- Treat your credit card as if it were cash: It’s easy to get carried away using credit or debit cards, or banking apps, as you don’t necessarily get the visceral sense that cash gives you of money changing hands. Try using your credit card only if you have the cash amount already sitting in your wallet or bank account, and can use it to pay off your card the same day as the transaction.

- Don’t use credit to pay off other debts: Under no circumstances should you use your credit card to pay off any other debts, as this can easily lead to a situation with you paying interest several times over on the same money.

Extra Tips to Improve Your Credit Score with a Credit Card:

- Use your credit card regularly: In order to build a good credit Score, you need to actually use your card. While keeping your credit card in a drawer at home will certainly help you avoid getting into debt, it won’t do much to help your credit Score.

- Never reach or exceed the credit limit: While you need to use your card regularly, the trick is to only use a small proportion of your available credit. On factor used to calculate a credit Score is your credit utilization, which measures what percentage of your available credit is actually used. Ideally, you want to keep this as low as possible.

- Keep a high credit limit: Your credit utilization is calculated as a proportion of your total overall credit. Let’s say you have $1000 dollars of available credit. If you spend $500 on credit, your utilization is already at 50%, which is a little too high. Meanwhile, if you spend $500 out of a total credit limit of $10,000, your utilization is only at 5%, a much better percentage for your credit score. Credit utilization is based on your total available credit, so you could either have several cards with a small limit, or one card with a high limit.

- Keep your credit utilization under 30%: The ideal utilization ratio is 30% or under. If you’re working your way up from a low credit score, try speeding up the process by keeping utilization to 10% only.

- Don’t close your old accounts: Because credit utilization is calculated according to your total available credit, closing old accounts will bring down your total credit limit and increase your utilization. Having multiple accounts is also good for your credit score.

- Have lots of cards: The number of accounts is factored into your credit score, with a 0-5 being ‘very bad’ and 21+ accounts being ‘excellent.’ While most people would struggle to manage over 20 accounts, it’s a good idea to have a few open.

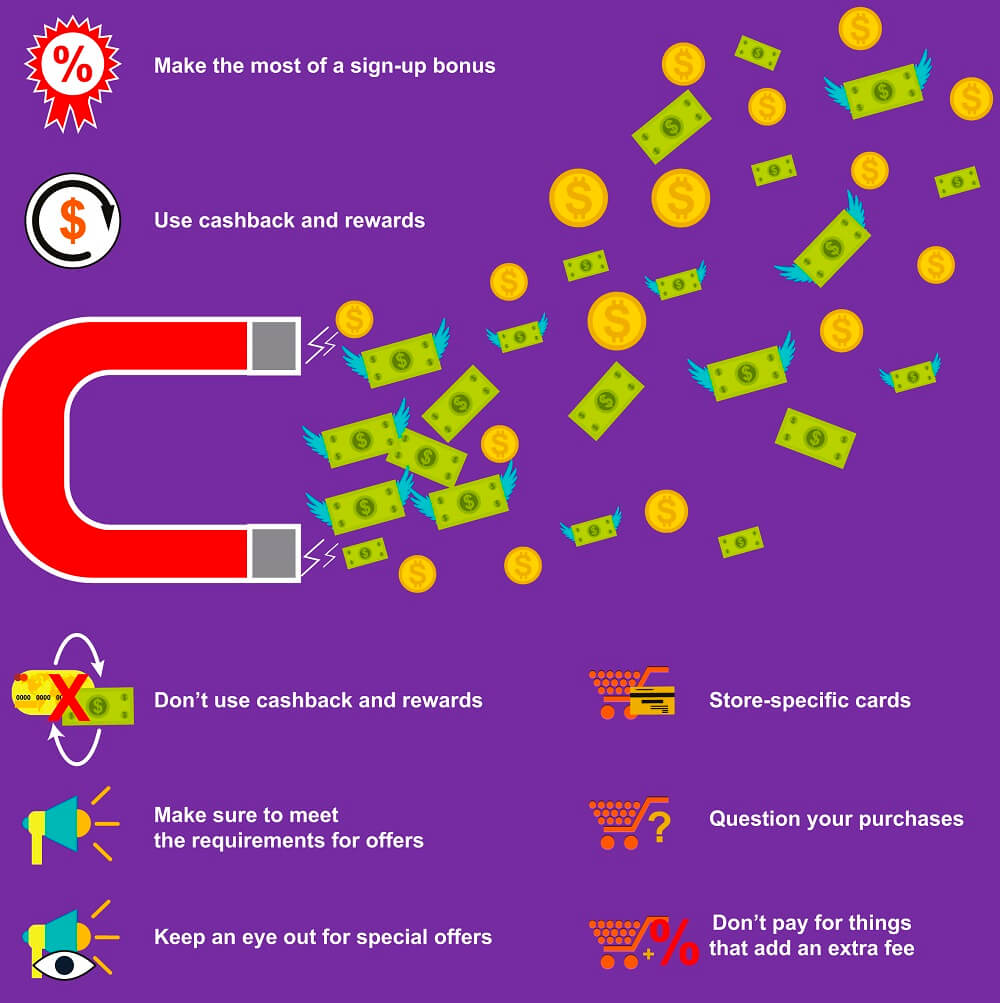

Tips to Save and Make Money Using Your Credit Card:

- Make the most of a sign-up bonus: Credit card companies want your business and many of them offer sign-up bonuses for new customers, some of which can be extremely generous. Shop around to see which cards have the best deal for you.

- Use cashback and rewards: Some cards offer cashback or rewards such as frequent flyer miles when you complete a transaction. Depending on the card, this can be a general reward, or it may apply to certain types of transactions, such as gas, restaurant bills and soon. Using cards strategically to make the most of the rewards can be a great way to save money, as long as you don’t mind putting the effort into planning which cards to use for what purchases.

- Don’t use cashback and rewards: While reward cards can be great for saving money, don’t plan your spending only according to what rewards you can get. Don’t feel that if you have a credit card that offers cashback on restaurant bills that you must go out to eat at restaurants all the time, if this isn’t already part of your lifestyle. This will only cause to spend money unnecessarily and won’t lead to savings! Your credit card rewards should be there to serve you, not pressure you into spending your money the way your bank wants you to. Search for rewards systems that suit your lifestyle and never spend something just to get the reward points!

- Make sure to meet the requirements for offers: Many banks require you to go through some process into order to receive your bonus or reward. You may have to complete a survey, register at the website or some other small administrative step. A surprising number of people lose their bonuses due to neglect; make sure to see the process through to collect your reward.

- Keep an eye out for special offers: Banks often have special offers in place, but oftentimes they do not widely publicize such offers. Find out where your bank advertises their offers (it may be a certain webpage) and check back regularly.

- Store-specific cards: Some stores offer their own credit card, which can be used only for transactions with that company. While this type of credit cards lacks the versatility of a regular card, it may be worth it for a store at which you regularly shop.

- Question your purchases: Never use your credit card to buy anything on impulse! Walk away: you can always come back later if you decide you really need an item.

- Don’t pay for things that add an extra fee: Some transactions charge an additional fee for credit card purchases. Utility bills and taxes often charge an extra 2-3% if you pay by credit card; in these cases, it’s best to choose another method of payment to avoid wasting money.

Tips to Prevent ID Theft and Fraud:

- Keep track of your purchases: Financial responsibility starts with you. It’s your job to keep track of your own transactions so that it’s easy to tell later on if errors have occurred. It’s a good idea to write down the details of your purchases so that you can compare your own records with your credit card statements later.

- Check your statements: Whether you receive a paper or electronic statements, be sure to look over them to check for errors or suspicious activity. You may find that charges have been made for things that you didn’t buy, or that you have charged the wrong amount.

- Keep receipts: It’s a good idea to keep receipts for items purchased on your credit card, at least until you receive your statement. That way, you have proof of the purchases you have made how much you should have been charged for every item, in case of errors.

- Never share your account details: As with any banking information, don’t give your details away unless it’s absolutely necessary. Keep your pin number private.

- Don’t give your card to another person: Keep your credit cards secure and don’t just hand them over for someone else to use. If you absolutely must lend someone you card, only give to someone you trust completely.

- Be smart with online shopping: Only shop at trusted websites with a good reputation for security. Always approach online stores with caution and don’t give banking details away unnecessarily. Never give your credit card details to anybody who approaches you online.

- Be smart with passwords: Choose secure passwords that can’t be easily guessed, and don’t share your passwords with others.

- Don’t use automatic login: Never choose a ‘remember password’ option on the computer. this makes it easier for you to forget or lose your passwords, and give hackers easier access to your information. Always enter your passwords manually.

- Don’t shop in public places: Use your personal computer or a secure computer at a trusted location to do any online shopping. Don’t enter your financial information into public computers that anybody can use after you, such as those at a library or internet café. If completing a transaction over the phone, be sure to read out your credit card details in private, where you can’t be overheard by bystanders.

- Ask for a chargeback: A chargeback is a refund for unauthorized charges to your card. Make sure that your credit card offers this or a similar mode of protection for your account. You should also contact your provider to immediately freeze your account if you notice suspicious activity.

Credit cards are all about personal and financial responsibility.

You get out of credit what you are willing to put in.

Behave irresponsibly and yes, you will end up with debt and a poor credit score, but if you take the time to choose your cards wisely and learn how to use them to their maximum potential, you can make the system work for you.

But if you take the time to choose your cards wisely and learn how to use them to their maximum potential, you can make the system work for you.

Good Luck!