If you want to invest while you have a small budget you may run into a few barriers.

But know this:

Investing is NOT only for the rich.

So…

What can you invest in that will generate some income?

Today I’m going to show you five investment ideas for times when you have a low budget.

Check it out:

* Embedding this infographic on your site is permitted, however, we request that you link back to this page.

You need to know more.

Let’s explore these points in more depth.

1. Pay a debt

Paying your debts can save thousands on interest payments.

By paying a little more than you need each month you can save a significant amount.

Potentially, the longer the loan – the more you can save.

Let’s see this example.

Bear with me on this one:

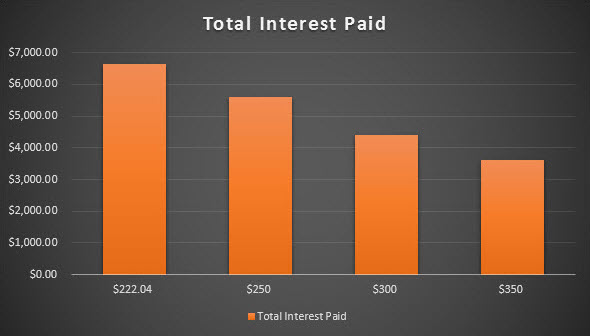

Let’s say you have a $20,000 loan, at 6% interest rate and a 10-year repayment period. If you are paying the standard amount each month you will pay $222.04.

But, if you decide to pay a little more you can make a huge difference over time.

Here’s a table of comparison between monthly payments for this example:

| Monthly payments | Interest paid | You save | Payoff time |

|---|---|---|---|

| $222.04 | $6,645 | $0 | 120 months |

| $250 | $5,605 | $1,040 | 103 months |

| $300 | $4,389 | $2,256 | 82 months |

| $350 | $3,612 | $3,033 | 68 months |

Just look at this total interest paid over time chart and see how significant are the savings:

So…

What should you do now?

Pay more each and every month for your debt – closing your debt as soon as possible should be a priority.

You can start small, even $30 a month can make a difference of over $1,000 as you saw in the example above.

2. Index Funds

First of all, you need to understand what an index fund is.

An index fund is a type of mutual fund constructed to match a particular stock index and follow it.

This gives you the ability to invest in the market without being at high risk.

For the average person it’s better not to invest directly in stocks because the risks are high, and let’s face it – You don’t know what you are doing exactly.

Index funds provide a great alternative as its diversified and considered very stable.

What are some good places to start?

Here are three companies you should check out their index funds:

- Vanguard Index Funds.

- iShares Exchange Traded Index Funds.

- Charles Schwab Index Funds.

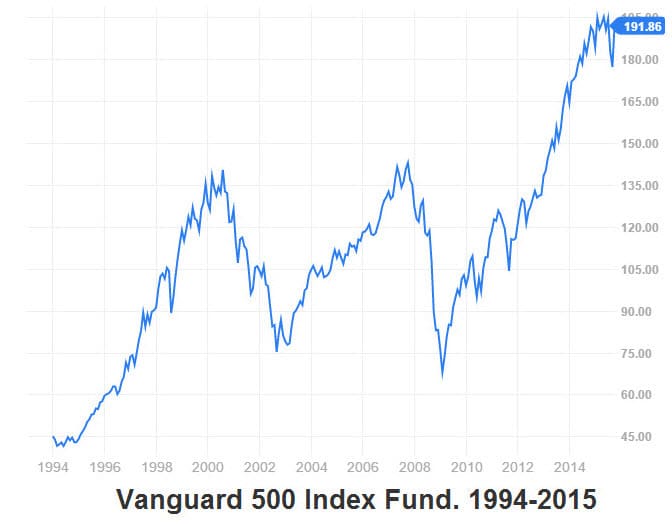

.:: Remember: Index Funds are a good investment for the mid-long term, short term is not recommended.

Here’s the Vanguard 500 Index Fund history:

3. Real Estate

Yes, real estate can be expensive.

But there are other ways to invest in real estate with a lower budget too.

The most effective way is REIT.

Now, what is it exactly?

REIT stands for ‘Real Estate Investment Trust’.

It’s a type of security that invests in real estate which provides you with 3 great advantages.

Here they are:

- It’s Liquid – Meaning you can withdraw your money at any time in a matter of days.

- It’s Cheap – Every REIT has a different minimum for investing and in any case, it’s much lower than buying a property for investment.

- It’s easy – You don’t need to manage any property, which can be a real hassle sometimes.

It gets better:

You can invest in any REIT fairly easily, as its very similar to stocks you can invest in them the same way.

Just set up an investment account through a brokerage or your bank (if it offers to invest in their online banking).

You should be able to do everything online after you set everything up with the company you chose to go with.

This is a big plus so you know always where your money is and how well it is doing.

4. Energy Efficiency

Improving energy efficiency in your home will reduce costs on your energy bill, permanently.

It’s a great way to invest a small amount and get a high return for it over time.

According to recent statistics for every $500 you spend on energy efficiency in your home you save $20 a month.

So…

How much is that really?

20 / 500 = 0.04

0.04 X 100 = 4

That’s 4% of tax-free money you don’t need to tell anyone about.

Here are 3 things you can do to make your home more energy efficient:

Let’s talk about these 3 things a bit.

- Seal it up – Plugging up leaks that allow cold air to slip into your home can save tons on your heating bills.

More than that, animals such as snakes, bugs, ants, mice and others are using them to enter your house.

Good areas to check include doors, windows, attic, and basement. - Programmable Thermostat – These devices can reduce between 5-20% of the energy being used.

It’s great for the cold winter as well as hot summers and they pay for themselves in about a year of use, after that – It’s pure profit. - Lighting – Using energy efficient light bulbs is as easy as it gets.

I wrote more about changing to a better lighting solution in my 17 Actionable Tips & Tricks to Save Money post.

Being energy efficient is highly recommended for both saving money and preserving the environment and so I encourage you to take action!

5. Emergency Fund

You might be wondering:

“How is putting some money aside is considered an investment?”

Well, paying interest on debt is exactly the opposite of investing, you pay someone else a monthly fee for the loan he gave you.

So, saving some money in case of emergencies can help you not falling into debt in the future.

If you’re not already saving some money on the side I truly believe that you should.

Take Action

Don’t wait!

Think of creative ideas you can invest your money in and get started.

Besides saving money for emergencies you should invest your money actively.

The sooner you start – the better, investments grow over time and there is no better time to start investing than right now.

Thank you so much for sharing these useful ideas to commence a small business with small amount. It will help me to become a rich person in future. I hope your ideas will do wonders for me if I hire paper writers and do exactly what you said in this article.