Another day, another government acronym thrown at me.

Why should I care about the FDIC?

The FDIC is who will insure your deposits if your bank or financial institution goes out of business.

They’ve been around since 1933 and were created to prevent people from withdrawing all of their funds from their banks during the Great Depression.

That was Uncle Sam’s way of doing damage control in the case of similar events in the future.

So yes, you can relax knowing that if your bank closes, the FDIC can give you the peace of mind in knowing that your money is insured.

Does the FDIC insure credit unions?

No. Federal credit unions are insured by NCUIF, the National Credit Union Insurance Fund.

When you open an account at a credit union, it’s a little different than opening a bank account.

At a credit union, you don’t make a deposit when you open an account. You become a member of the credit union and the money you put in your account is called shares.

How is the FDIC set up?

The FDIC has a Board of Directors, which consists of 5 members:

- Chairman

- Director

- Comptroller of Currency (oversees all United States financial institutions)

- Director of Consumer Finance Protection Bureau

The organization is set up into 7 divisions:

- Division of Finance

- Division of Information Technology

- Division of Administration

- Division of Depositor and Consumer Protection

- Division of Resolutions and Receivership’s (this is the division that saves failed banks)

- Legal Division

- Division of Insurance and Research

What do you mean when you say my bank failed?

A bank fails when it can’t fulfill its obligations to account holders or other creditors. The most common reason for a bank failing is because the market value of its assets have lost so much value that they are a lower value than its liabilities.

They could have lost a lot on their investments, or might not be able to take out cash when account holders request withdrawals.

When you put money in your bank account, the bank invests that money. A common way they do this is by making loans available to other customers. These loans earn interest, which in turn allows you to earn interest on your deposits.

I could read about different kinds of insurance as a cure for insomnia. What do I need to know about deposit insurance?

Deposit insurance is what will protect your money if your bank goes out of business.

It will insure deposits for at least $250,000, depending on the amount of funds and what kind of account(s) you have set up.

Who qualifies for FDIC insurance coverage?

- Individuals

- Corporations

- Partnerships

- Limited Liability Corporations (LLCs)

- Cities

- Counties

The FDIC insures the following types of accounts:

- Checking accounts

- Savings accounts

- Certificates of deposit (CDs)

- Money market accounts

All of the above are insured by the FDIC for up to $250,000.

The FDIC does NOT insure these kinds of accounts:

- Mutual funds

- Annuities

- Life insurance policies

- Stocks

- Bonds

- Safe deposit boxes

- Treasury securities (TBills)

- IBF (International Banking Facility Time Deposit) account

So my safe deposit box (and everything in it) isn’t covered. That’s a little scary.

Fret not, there are a couple options to ensure your safe deposit box is covered. I would recommend the following:

- Ask your bank about insurance options. Most banks usually offer limited coverage on safe deposit boxes.

- Reach out to your insurance agent. Your homeowner’s insurance policy may cover a partial amount of the safe deposit box.

If your bank fails, your safe deposit box should be available the first business day after your bank closes. If your bank is acquired, it’ll remain in the same location. If your bank closes, the FDIC will contact you about removing your safe deposit box.

How do I get deposit insurance?

You don’t have to apply for deposit insurance. You get it automatically after opening an account at an FDIC insured bank.

How do I know if my bank is FDIC insured?

There are many ways you can find out if your bank is insured by the FDIC:

- Ask a bank employee

- Call the FDIC at 877/2753342

- Use the FDIC website’s Bank Find Tool

- Look for the FDIC sign (pictured below) at your bank

This sign should be displayed in the bank’s window and teller windows, as well as on the bank’s website.

Can online banks be FDIC insured?

Yes. Before deciding to open an account with an online bank, I would recommend checking that the bank has the FDIC logo displayed on their website.

How much deposit insurance do I qualify for?

FDIC insurance usually covers up to $250,000 per ownership category, per bank. If you have two accounts, each at a different bank, both accounts would have their own separate insurance.

Let’s say you have $250,000 in one bank and $250,000 in a second bank. Both $250,000 deposits will be insured.

From 1980 until 2009, the amount of deposit insurance was $100,000 per ownership category. It was increased to $250,000 in 2009, due to the 2008/2009 financial crisis.

I have multiple accounts at the same bank. How does that work with FDIC coverage?

FDIC coverage is based on an ownership basis, not on the number of accounts you have open. Please note, some banks may have different names on the sign, but are owned by the same company.

Can I have over $250,000 of deposit insurance at the same FDIC insured bank?

Yes. This depends on whether you have accounts spread across different types of ownership (see below).

The 5 types of ownership listed below are insured separately for up to $250,000 for FDIC coverage:

- Single account

- Joint account (owned by two or more people, qualify for up to $250,000 per account holder)

- Revocable trust account (up to $250,000 per beneficiary)

- Retirement account

- Business account (up to $250,000 per each corporation, partnership or LLC)

My bank failed and I had more money in my account than what was covered by FDIC insurance. What happens to the uninsured funds?

For example, let’s say you had $300,000 in your account, and were eligible for $250,000 of FDIC coverage. I have detailed the process below:

- You’ll be given a Receiver Certificate for the uninsured $50,000.

- This Certificate will allow you to file a claim against the bank’s assets.

- As the bank sells and liquidates their assets, you’ll receive payment for the remaining $50,000.

Please keep in mind, you may only get a portion of the insured funds back. Also, payment is not guaranteed for uninsured funds.

I would recommend looking at the ways to make the most of your FDIC insurance (toward the end of this article).

I have a joint account and live in a community property state. Will that affect my coverage?

No. Even though joint accounts under both a husband and wife’s name are considered jointly owned by the state, they are considered individual accounts for deposit insurance purposes.

I have a joint account. If we have one account set up under one account holder’s Social Security Number and a second account under another account holder’s Social Security Number, does this increase my coverage?

No. Both accounts would be considered under the same type of ownership (joint account) and would be eligible for up to $250,000 worth of coverage.

What happens to FDIC coverage if an account holder dies?

The death of an account holder usually results in less coverage, especially in the case of a joint account.

There will be a 6 month grace period after the death, in which the account will keep the same amount of coverage it had when the account holder was alive. After the 6 month grace period, the account will be insured based on the ownership category it’s established under.

I have a revocable trust account. Who is eligible to be a beneficiary?

A beneficiary can be a living person, a charity (per IRS rules – Exemption Requirements) or nonprofit organization (also subject to IRS rule – Other Tax-Exempt Organizations).

Please note, the trust relationship must be listed in the account title.

How does FDIC coverage work for my investment in a brokerage account?

A common mishap with brokerage accounts is when a broker puts an investor’s funds in a combined account with other investments.

If the account isn’t properly set up, it’ll only be insured for $250,000, regardless of how many investors may be involved with the account.

As such, I would recommend asking your broker what bank your investment is in, and that you keep track of the account balance.

What’s the difference between how personal and business accounts are handled when it comes to FDIC coverage?

Money deposited into business accounts are insured separately from any stockholders, partners or members of the company’s personal accounts.

In order to qualify for coverage, the business owner must show that the organization was set up for an independent activity. This means that the business has a purpose other than being set up just to get FDIC coverage.

You can prove this with the following, separate from your personal accounts:

- Tax identification number

- Charter (telling the purpose of your business) or bylaws (the internal procedures for daytoday operations in your business)

Is my business eligible for additional FDIC insurance?

No. Each corporation, partnership or LLC can’t have over $250,000 of deposit insurance at one bank.

If your business has two separate accounts at the same bank, these accounts are combined and can be insured up to $250,000.

I am not a United States citizen or resident and my bank is closing. Is my money insured?

As long as the office or branch that you manage your account at is located in the United States, yes, your funds will be covered by FDIC insurance.

If your funds are in an FDIC insured branch of a foreign bank, you are entitled to coverage.

My bank was taken over by the FDIC. How long will it be before they open again?

There isn’t a set time frame for when the FDIC will be able to reopen a failing bank.

In a situation without unforeseen circumstances, the FDIC tries to close the bank on a Friday and resume “business as usual” the following Monday.

I have an account in the United States, but the money’s in foreign currency. Am I still eligible for coverage?

Yes, the insurance amount is estimated by determining the equivalent value of the foreign currency in USD (United States dollars).

These are calculated by the buying rates at 12:00 PM on the day the bank defaults for cable transfers from the Federal Reserve.

How is trust account coverage calculated?

For trust accounts, only the beneficiaries are insured, not the owners.

There are two types of revocable trust accounts:

- PayableOnDeath (POD) accounts, where you can put the beneficiaries’ names on the account card.

- Living Trusts, which are part of an estate plan.

My bank got robbed. Is that covered by the FDIC?

No. I would recommend reaching out to your bank directly for more information, as coverage for robberies varies.

Usually, the bank will be ensured by a Banker’s Blanket Bond, which is insured separately from the FDIC, and is used to cover losses from theft.

If you discover someone has accessed your account and stolen money from it, please contact your bank and local law enforcement to start the investigation process.

Does the FDIC insure natural disasters like fires and floods?

No, natural disasters are not covered by FDIC insurance. If your bank was destroyed by a natural disaster, please call your bank or visit their website to see if they have any information about the next step.

How can I check if my bank accounts are FDIC insured?

You can check if your accounts are covered by using the FDIC website’s online calculator, EDIE .Click “Use Edie Now!”.

You’ll want to know the answers to the following questions:

- Who owns the account(s)?

- What FDIC ownership category is the account under? Refer to the above section about the 5 types of ownership if you’re not sure.

How does a bank qualify to be FDIC insured?

According to the Federal Reserve’s website, the bank would need to show that it would have enough capital to sustain its risk profile, along with any losses and future growth.

Does the FDIC actually close banks?

If an insured bank fails, the FDIC will take over the bank until either of the following occurs:

- Purchase and Assumption: this means another FDIC covered bank would take over the failed bank’s accounts. This usually happens pretty quickly and is the preferred and most common way a bank closing is handled.

- Deposit Payoff: the FDIC closes the bank in liquidation, then pays the insured amounts to the account holders.

What if my bank isn’t FDIC insured?

I would recommend transferring to an FDIC insured bank. If a non-FDIC covered bank closes, there’s no guarantee that you’ll get anything back from your accounts.

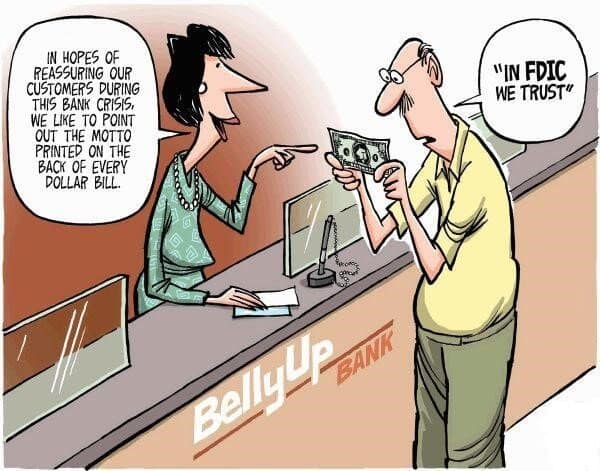

My bank’s going bellyup. How can I check if I’m insured?

Check your bank’s coverage status at this link from the FDIC’s website.

When it rains, it pours. My bank closed, I’ve had about of financial hardship and I’m behind on my loan. What should I do?

Contact the FDIC directly to try to work out a solution. Any proposal needs to be submitted in writing, along with your current account information and anyway you can demonstrate financial hardship.

This will be helpful to the FDIC to determine your eligibility as they research the situation.

A few examples of ways you can prove financial hardship are:

- Lease/Mortgage bill

- Pay Stubs or W2

- Income tax returns from the previous year

- Property tax bills

- Saving or checking account statements from the past 36 months

- Utility bills

Usually, they will attempt a loan modification, to adjust the monthly payment amounts more toward what you are able to pay.

If a loan modification is not an option for you, the FDIC may try to settle the debt for less than what’s currently owed.

Please note that the FDIC is required to report debt forgiveness to the IRS. If you are looking to settle a debt with the FDIC, I would recommend contacting a tax professional for assistance.

If loan modification and settlement are not options, the FDIC may pursue other options, like legal action, for repayment of the debt.

How does the FDIC insure employee benefit accounts?

First of all, you’ll want to make sure your employee benefit account is eligible for FDIC coverage based on the following criteria:

- Per Section 3(3) of the Employee Retirement Income Security Act (ERISA) of 1974: “The term ‘employee benefit plan’ or ‘plan’ means an employee welfare benefit plan or an employee pension benefit plan or a plan which is both an employee welfare benefit plan and an employee pension benefit plan.

- The plan must be overseen by a plan administrator.

- The plan administrator keeps proper documentation of the plan.

- The plan must be set up as an employee benefit account at the bank.

After all of the above is met, the employee benefit account would be eligible for insurance of up to $250,000.

Would my employee benefit account be insured separately from any other accounts I have at the same bank?

Yes. The FDIC sometimes calls this “passthrough” coverage because the employer set up the account and passes the coverage onto the employee.

Hold your horses. Is my money as insured as I think it is?

Yes. Ever since the FDIC was started on January 1, 1934, not a single penny of insured deposits has been lost.

How can the FDIC guarantee the insurance?

Wipe the sweat off your brow. The FDIC is backed by “full faith and credit” of the United States government.

They get their money from premiums that United States banks and financial institutions pay into a Deposit Insurance Fund (DIF) to ensure FDIC coverage. The FDIC invests those premiums into United States treasury securities.

If the DIF can’t cover the amount needed, the FDIC has $30 billion that they can borrow from the Department of Treasury. The FDIC can also borrow in short-term loans from the Treasury like they did during the savings and loan crisis in 1991.

What does “full faith and credit” mean?

This means that the United States government can unconditionally guarantee that they will stand behind the deposit insurance.

If my bank’s taken over by the FDIC, will I still be able to use the cute checks I just ordered? I don’t want to start over with boring plain checks just because my bank couldn’t keep it together.

Nope, you can continue to use your cute checks. However, please keep in mind that eventually, you’ll get checks with the new bank’s logo on them (usually after you run out of ones from your current checkbook).

However, like anything else in life, I can’t guarantee that the new bank will have cute checks.

In addition, if your bank is acquired, you’ll still be able to use your credit and debit cards.

My bank closed. When will I get my money?

The FDIC is required to make the money available “as soon as possible” under federal law. This means you could get your money as quickly as within 2 business days after your bank closes.

Your account could remain at your current bank, if it was taken over by the FDIC, or it could be transferred to a nearby FDIC insured bank.

What happens to my direct deposits if my bank closes?

If your bank was acquired, it will automatically direct deposit to your account with the new bank.

If you bank was closed, the FDIC will try to find a nearby FDIC insured bank to transfer your account to.

My bank failed. Does this mean I’m off the hook with my loan?

Not necessarily. Before your bank closes, the FDIC will send you a notice in the mail to let you know of the updates. This will usually include new points of contact for any questions, and updated instructions on where/how to submit payments.

Since the FDIC isn’t a bank, it recommends you to find a new lender to finish out the remaining terms of your loan.

My bank failed and was taken over by the FDIC. I need to request more funding for my loan. How do I do this?

You’ll want to contact the FDIC directly. You will need to submit a written request asking for additional funding.

FDIC employees usually are able to meet with customers within 1 business day after the bank fails.

You can reach them by calling the failed bank’s phone number.

Also, the FDIC sends out a press release anytime a bank fails, with a 1800 number for each failed bank. You can find this phone number by going to the Press Release section of the FDIC website.

The FDIC will decide your eligibility for additional funding based on your account history with the failed bank. They will reach out to you if they have any additional questions.

One of three things will happen after the FDIC evaluates your request:

- They will make all or a portion of the loan available (based on their analysis of your account history).

- They will meet with you to discuss restructuring or modify the terms of your loan.

- Your request for additional funds will be denied.

My bank failed and the FDIC sold my loan. What happens now?

The bank that took over your loan and the FDIC will mail you an update, letting you know who to reach out to for questions and where/how to submit payment on your loan.

The sale will not affect the loan terms you originally agreed on. The new bank will be subject to all the same state and federal laws regarding your loan.

Ugh, So the FDIC is one more thing my hard earned tax dollars go toward?

No, don’t waste your taxpayer’s woe on this one. The FDIC is not funded by taxes. FDIC insured banks and financial institutions pay premiums to fund deposit insurance.

How can I make the most of my FDIC coverage?

Spread it across multiple banks (again, I would recommend checking to make sure that they are separate banks and not under the same umbrella corporation).

How can I get more information about the FDIC? Who can I contact to answer my questions?

General Questions:

There are several ways you can contact the FDIC:

- By Phone: Call 1/8772753342 (ASKFDIC). Their hours are (Eastern Time):

8:00 am 8:00 pm Monday Friday 9:00 am 5:00 pm Saturday Sunday Closed on Federal Holidays

- FDIC Website: You can fill out this Customer Assistance Form

Topic Specific Questions:

- FDIC Website: Contacts by Subject

Final Note

I hope this helped answer any questions you may have had about the FDIC. If you have any further questions, don’t hesitate to check out the FDIC website or comment below.

A very informative article to read.Thanks a lot for posting this.Good Work.Keep it Up.

Thanks for the kind words (: