Wells Fargo Bank was founded in 1852 by Henry Wells and William Fargo, who at that time used to sell and buy gold and bank papers that were as good as gold at that time.

Since then, the company has evolved and now serves 41 states with more than 6,000 branches around the country and a highly qualified customer service and banking experience

- Routing Numbers & Wire Transfer

- Wells Fargo Headquarters Info

- Credit Card Login Information

- Branch / ATM Locator

- Website: https://www.wellsfargo.com

- Routing Number: 121000248

- Swift Code: WFBIUS6S

- Mobile App: Android | iPhone

- Telephone Number: 1-800-869-3557

- Headquartered In: California

- Founded: 1852 (174 years ago)

- Bank's Rating:

- Español

- Read this tutorial in

Wells Fargo’s online banking system provide you with easy access to your bank account in order to manage your financial assets such as savings accounts, deposits, investments and securities through the bank and more. You can also track debt and loans through the online panel.

How To Log In

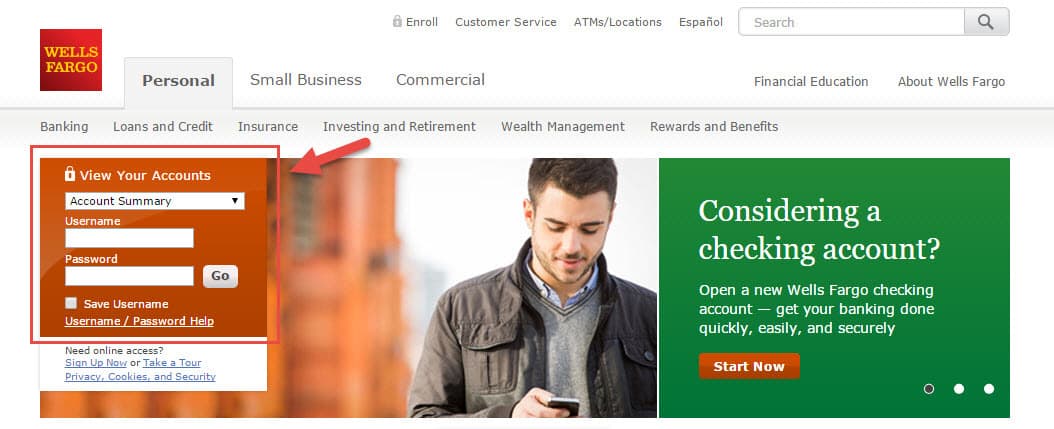

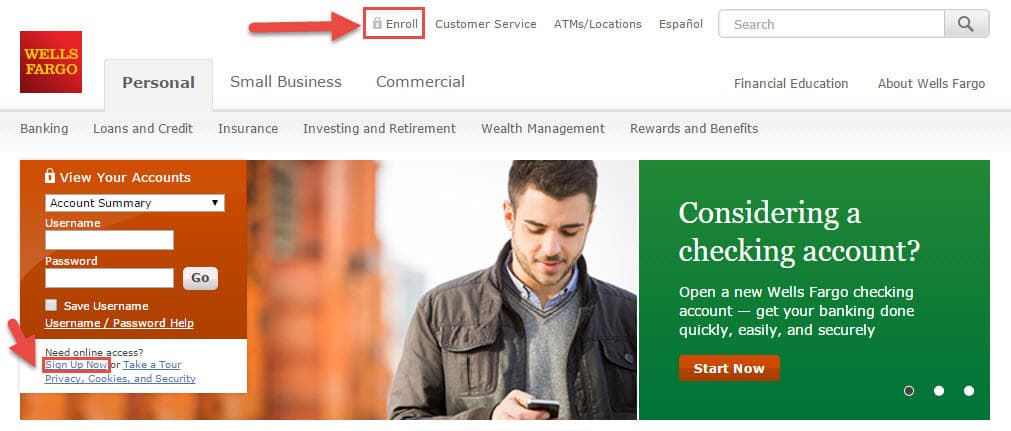

Step 1 – Open the website in a new window by clicking here and see the upper left of the screen, you will see the box titled “View your accounts”:

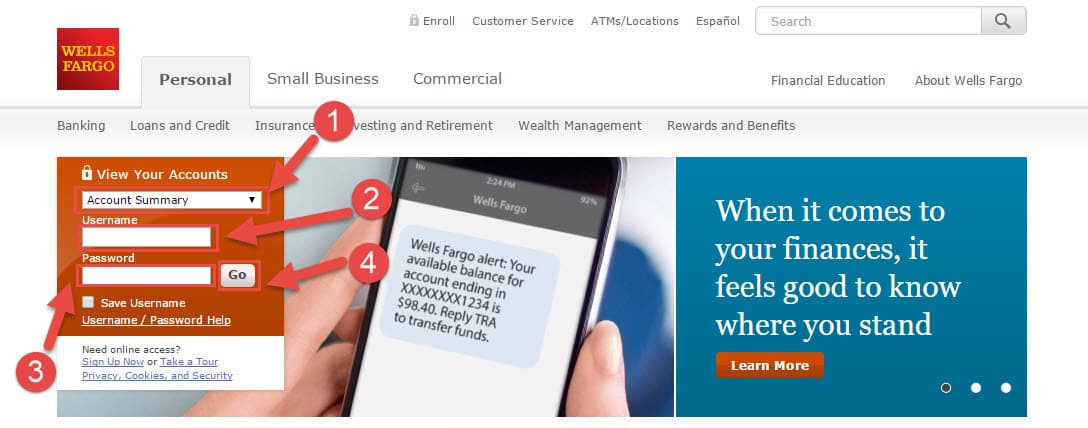

Step 2 – Choose what you need from your account, type your User Name, type your Password and click the “Go” button:

You should have logged in if all your data is correct. Note that you can use the “Save User Name” option in the box to save it to your computer, but this is not recommended on computers that other people use or on public computers.

USER NAME / PASSWORD FORGOTTEN

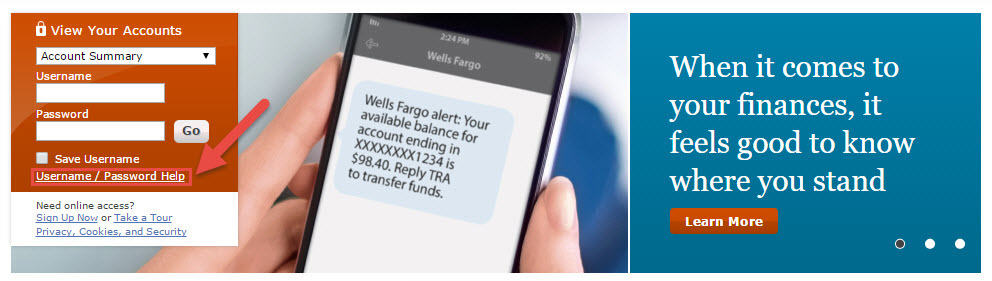

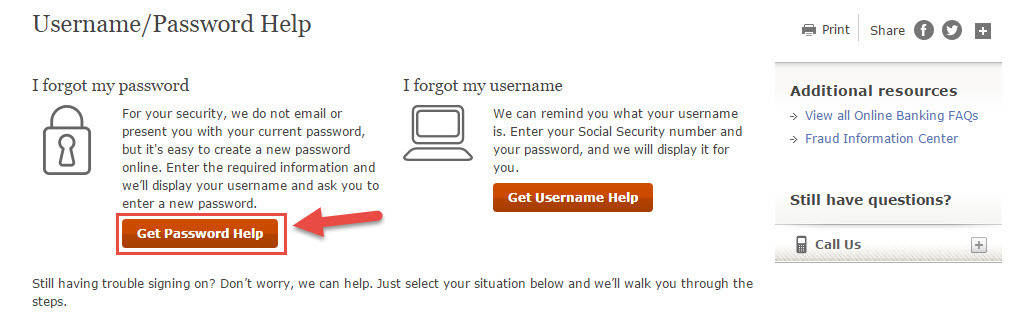

Step 1 – If you forgot your Username or your password, you must click on the “Help Username / Password” link on the home page:

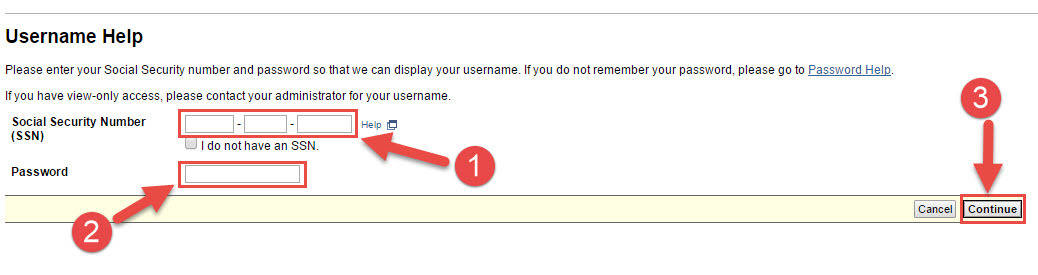

Forgotten Username

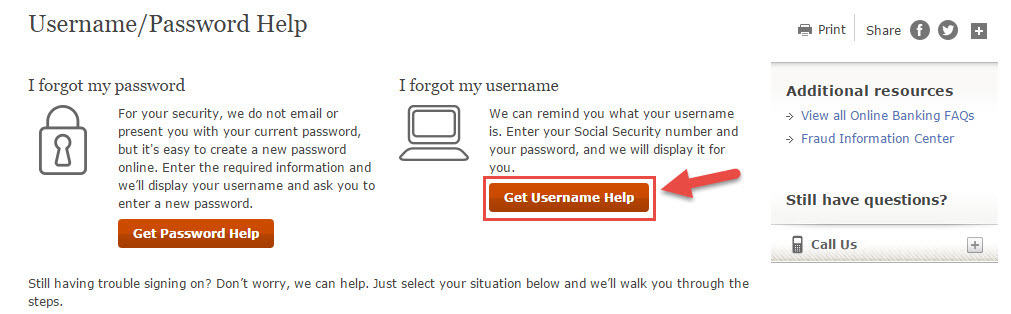

Step 2 – If the Username is what you have forgotten, click the “Get Help for Username” button:

Step 3 – Enter your security social number (SSN) and your password, then click “Continue”:

You will now see your user name on the screen if you entered the correct social security number and password for your account.

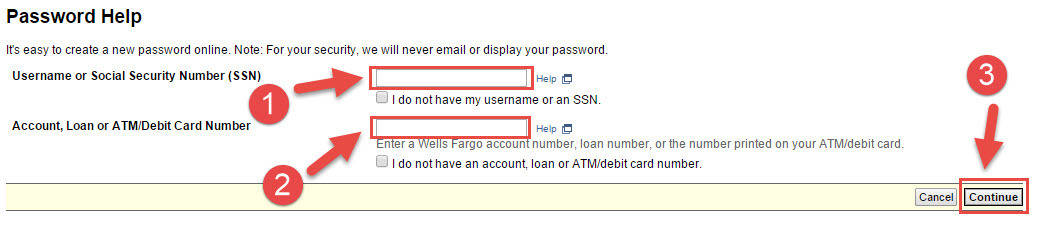

Forgotten password

Step 2 – If the Password is what you have forgotten, click the “Get Password Help” button:

Step 3 – Enter your User Name or Social Security Number (SSN) in the first field and your account, loan or ATM/Debit card number in the second field, then click “Continue”:

HOW TO ENROLL

Step 1 – Click the “Sign Up” or “Enroll” links (no matter which one you choose):

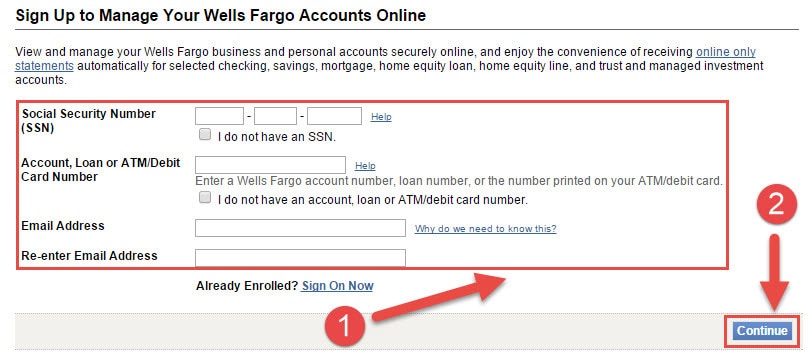

Step 2 – Fill in the fields in the registration form and click the “Continue” button:

If all went well, you should now have access to your online bank account.

Video Instructions

Federal Holiday Schedule for 2025 & 2026

These are the federal holidays of which the Federal Reserve Bank is closed.

Wells Fargo and other financial institutes are closed on the same holidays.

| Holiday | 2025 | 2026 |

|---|---|---|

| New Year's Day | January 2 | January 1 |

| Martin Luther King Day | January 20 | January 19 |

| Presidents Day | February 17 | February 16 |

| Memorial Day | May 26 | May 25 |

| Juneteenth Independence Day | June 19 | June 19 |

| Independence Day | July 4 | July 3 |

| Labor Day | September 1 | September 7 |

| Columbus Day | October 13 | October 12 |

| Veterans Day | November 11 | November 11 |

| Thanksgiving Day | November 27 | November 26 |

| Christmas Day | December 25 | December 25 |

Wells Fargo Review

Wells Fargo is a multinational banking and financial services holding company based in San Francisco, California. The bank is the third largest bank in the United States and the second largest bank in the world by market capitalization.

Wells Fargo was founded in 1852, and in its current form, it is a result of a merger between Wells Fargo & Company and Norwest Corporation in 1998 and the acquisition of Wachovia. As of 31st December 2015, the bank had 8,700 branches and 13,000 ATMs. The bank operates across 35 countries and has more than 70 million customers around the world.

In February 2014, the bank was named the most valuable bank brand in the world for the second year running.

Our review. at a glance:

If you are considering opening an account with Wells Fargo, you have to consider the pros and cons. In this Wells Fargo bank review, we’ll cover everything that will help you make an informed decision whether to open an account with the bank of not.

Benefits

There are many benefits that you will gain when you open an account with the bank. Knowing this will help you to decide whether you should open an account with Wells Fargo or not. The benefits:

- Wells Fargo has more than 8,700 branches and 13,000 ATMs nationwide, which means that customers are never far from the bank’s banking location

- The bank offers four different checking accounts for businesses of different sizes and shapes. Whether it is a large company or sole proprietorship, the bank has a business checking product for everyone

- Although the bank’s business checking comes technically with monthly fees, you are likely not to pay the fees. The bank offers business customers a few ways to waive their monthly fees, including maintaining a certain minimum balance and also through debit card purchases

- Customers who link their business credit cards to their checking account get some amazing perks, like travel rewards, cash back on purchases and more

- Wells Fargo offers internet banking services for all its accounts. This makes it easy for users to manage their bank account from the comfort of their homes or even when they are on the go through their mobile phones.

- Money transfer between Wells Fargo accounts has been made easy

- The bank’s website has an easy-to-use interface and customers can easily access their e-statements

- Online customer support is readily available as it only takes a few seconds to connect to an online representative

Downsides

Just like other banks, Wells Fargo has its own downsides which you must know before opening an account with the bank. They include:

- Wells Fargo’s rates for interest savings and checking accounts are low. With the interest at 0.03-0.06% APY, you don’t have much reason to maintain high balance in your account

- Although the bank’s Android app works great, their iOS version isn’t the best. iPhone users have reported many issues with the bank’s business apps

Wells Fargo recommended package

You can’t find a one-size-fits-all solution, but many small businesses would want to choose Choice checking account. It is not too restrictive and has room for growth.

And if you get a business credit card from the bank, you can enjoy their reward program which basically includes car rentals, airline tickets, cash back, hotels and more.

Savings accounts

The bank doesn’t have the worst interest rates for savings in the industry, but they are certainly far from the best. The bank offers two business savings accounts: Platinum and Market Rate.

Platinum: This account has a 0.05-0.06% interest rate, and a $15 monthly fee is waived for customers maintain a minimum balance of $10,000

Market Rate: This account has a 0.03% interest rate and a $6 fee is waived for customers who maintain an average balance of $500 or a $25 monthly fee from the business checking account

Customer reviews

You will often find that the largest collection of honest customer reviews for big banks is in their mobile reviews.

In the case of Wells Fargo, it seems they are happy with the lack of high fees and convenience of having many branches around the nation. One complaint that has prevailed for some time now is that of the iOS app, which they say has annoying load times.

Wells Fargo’s Android app has been rated 4.3 stars out of 5 from 191.514 reviews, whereas the iOS app has a rating of 2.9 stars out of 5 from 44,266 reviews.

Although the performance of the bank’s apps can be slightly inconsistent, it’s good news that we didn’t find other trends in their reviews, other than some customer support issues which certainly come with the territory especially for big banks like Wells Fargo.

FAQ

#1 How easy is it to open an account with Wells Fargo?

Well, opening an account with Wells Fargo is pretty simple. You can easily apply online or simply visit the nearest Wells Fargo branch. All the information you need to provide during the application process is your EIN, address, phone number, and other basic info.

#2 How do I make deposits?

You can make deposits at the nearest Wells Fargo branch, at any Wells Fargo ATM or the CEO Mobile app.

#3 What perks accompany checking accounts?

Both Analyzed and Platinum accounts are very interesting bearing, although with low rates. If you decide to add them, the bank’s business credit cards have great travel rewards and cash-backs.

(14 votes, average: 3.50 out of 5)

(14 votes, average: 3.50 out of 5)

Someone know how can I change my address on file? I’m not a very internet savvy person. thanks.

If you’re not very comfortable with internet use I would suggest to call to their customer support, in my experience they do a pretty good job and answer quite promptly. good luck.